for week ending February 17, 2021

In the News:

Freeze-offs contribute to lower natural gas production, higher natural gas prices

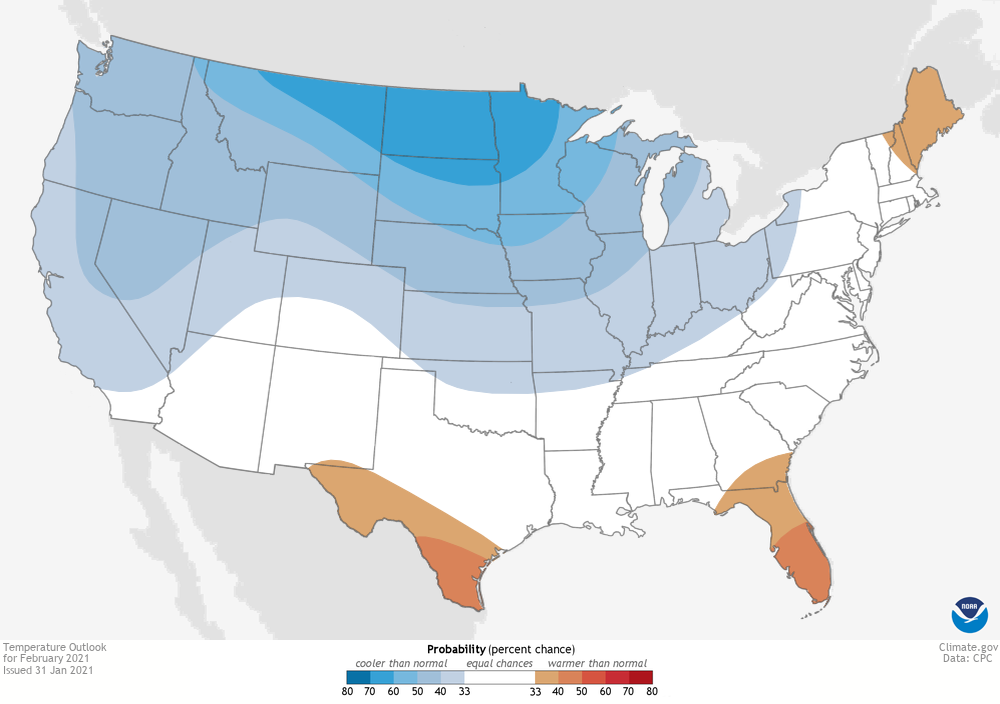

In the wake of record-low temperatures affecting most of the country, dry natural gas production in the United States fell by 21.0 billion cubic feet per day (Bcf/d), declining from 90.7 Bcf/d on February 8 to about 69.7 Bcf/d on February 17, according to data from IHS Markit. The decline in natural gas production is primarily because of freeze-offs, which occur when water and other liquids found in produced raw natural gas freeze at the wellhead and/or potentially in natural gas gathering lines near production activities, resulting in flow blockage. A large portion of the decrease in natural gas production was from declines in Texas, which fell over 10 Bcf/d during the February 8–17 period. Unlike natural gas production infrastructure in northern areas of the country where below-freezing temperatures are more common and infrastructure is generally winterized, wellheads, gathering lines, and even processing facilities in Texas are more susceptible to freeze-offs during periods of extremely cold weather.

Unusually strong winter season heating and power demand for natural gas, combined with the sudden decrease in natural gas production, led to large price increases at many natural gas hubs this week. The price of natural gas at the Waha Hub, near natural gas production activities in the Permian Basin, rose to over $206 per million British thermal units (MMBtu) on February 16, according to Natural Gas Intelligence (NGI), the highest reported price at the Waha Hub since at least 1995. The price at the Chicago Citygate also reached an all-time high of nearly $130/MMBtu on February 12. Prices at the Oneok Gas Transmission (OGT) pipeline in Oklahoma averaged $1,192/MMBtu on February 17, the highest in the country according to NGI.

The cascading effects of the supply/demand imbalance resulted in upward price pressures in some demand markets less affected by the recent cold weather. For example, the price at SoCal Citygate, in Southern California, which receives a significant amount of natural gas from the Permian Basin production region, reached a record high $144/MMBtu despite temperatures in Los Angeles being near normal over the past several days.

In Texas, the cold temperatures have had a significant impact on the electric grid, including the loss of available generating capacity. The loss of generating capacity led the Electric Reliability Council of Texas (ERCOT) to enter emergency conditions and initiate rotating blackouts to shed 10,500 MW of load, the equivalent of nearly two million homes. As of February 18 morning, nearly 40,000 MW of generation remains off the system: 23,500 MW is thermal and 16,500 MW is wind and solar, according to ERCOT.

Overview:

(For the week ending Wednesday, February 17, 2021)

- In response to record-breaking low temperatures across most of the Lower 48 states, and production losses as far south as the Gulf Coast, natural gas spot prices rose at most locations this report week (Wednesday, February 10 to Wednesday, February 17). The Henry Hub spot price rose from $3.68 per million British thermal units (MMBtu) last Wednesday to $23.61/MMBtu yesterday, the highest nominal price going back to at least 1993. In real terms (adjusted for inflation), yesterday’s price is the highest price since February 2003.

- At the New York Mercantile Exchange (Nymex), the price of the March 2021 contract increased 31¢, from $2.911/MMBtu last Wednesday to $3.219/MMBtu yesterday. The price of the 12-month strip averaging March 2021 through February 2022 futures contracts climbed 12¢/MMBtu to $3.158/MMBtu.

- The net withdrawals from working gas totaled 237 billion cubic feet (Bcf) for the week ending February 12. Working natural gas stocks totaled 2,281 Bcf, which is 4% lower than the year-ago level and 3% more than the five-year (2016–2021) average for this week.

- The natural gas plant liquids composite price at Mont Belvieu, Texas, rose by 25¢/MMBtu, averaging $7.66/MMBtu for the week ending February 17. The prices of natural gasoline and isobutane rose by 2% and 1%, respectively. The price of normal butane remained flat week over week. The average weekly ethane price rose 6% on the back of rising natural gas prices, while the propane price rose 4% on growing heating demand. The propane price at Mont Belvieu is now highest since October 2018.

- According to Baker Hughes, for the week ending Tuesday, February 9, the natural gas rig count decreased by 2 to 90. The number of oil-directed rigs rose by 7 to 306. The total rig count increased by 5, and it now stands at 397.

more summary data

Prices/Supply/Demand:

Prices in some regions of the country set records amid record-low temperatures and supply disruptions. This report week (Wednesday, February 10 to Wednesday, February 17), the Henry Hub spot price rose $19.93 from $3.68/MMBtu last Wednesday to $23.61/MMBtu yesterday, the highest inflation-adjusted price since February 2003. Temperatures across the Lower 48 states were much colder than normal, especially in the middle of the country and in Texas, where snow and ice resulted in blackouts to about 4.5 million customers.

Midwestern prices rise to record-setting levels. At the Chicago Citygate, prices rose to $129.52/MMBtu on Friday, the highest price on record going back to 1993. Week on week, the Chicago Citygate price increased $14.83 from $3.99/MMBtu last Wednesday to $18.82/MMBtu yesterday. OGT, the ONEOK Gas Transportation delivery point for Oklahoma, increased $1,184.26/MMBtu from $8.60/MMBtu last Wednesday to $1,192.86/MMBtu yesterday, the highest price on record by far for any major hub going back to 1993.

Natural gas prices throughout Texas reached record highs, with significantly higher prices than in neighboring Louisiana. The price at the Waha Hub in West Texas, which is located near Permian Basin production activities, averaged $4.54/MMBtu last Wednesday, 86¢/MMBtu above the Henry Hub price. Yesterday, the price at the Waha Hub averaged $64.22/MMBtu, $40.61/MMBtu above the Henry Hub price. Producers throughout the region are reporting well freeze-offs, affecting natural gas and crude oil production at the wellhead. The ability of pipelines and processing infrastructure to deliver natural gas to consumers is further impaired by rolling electricity outages and exposure of un-winterized equipment to record-setting low temperatures. Prices at major Texas hubs set all-time records on Tuesday (going back to 1993) with the Katy Hub at $352.64/MMBtu and Houston Ship Channel at $400/MMBtu, before falling yesterday to still record-setting levels of $216.54/MMBtu and $358.77/MMBtu, respectively. Prices at both hubs were approximately $4.50/MMBtu last Wednesday.

Prices in neighboring Louisiana rose, but by less than prices in Texas. The South Louisiana regional average price increased $12.34/MMBtu, from $3.62/MMBtu last Wednesday to $15.96/MMBtu yesterday, the highest price on record.

California prices are mixed, reflecting differing sources of supply. The price at SoCal Citygate in Southern California, which sources much of its natural gas from western Texas, increased $21.96 from $4.97/MMBtu last Wednesday to $26.93/MMBtu yesterday, after reaching an all-time high of $144.00/MMBtu on Friday. The price at PG&E Citygate in Northern California, which draws on natural gas supplies from the Rockies and Western Canada, remained relatively steady, rising $2.79, from $4.11/MMBtu last Wednesday to $6.90/MMBtu yesterday, after reaching a weekly high of $8.87/MMBtu on Tuesday.

Northeast price increases relatively muted, reflecting near-normal winter temperatures in the region and proximity to the Appalachian production region. At the Algonquin Citygate, which serves Boston-area consumers, the price went down 96¢ from $11.56/MMBtu last Wednesday to $10.60/MMBtu yesterday, after reaching a weekly high of $12.78/MMBtu last Thursday. At the Transcontinental Pipeline Zone 6 trading point for New York City, the price increased $8.81 from $4.69/MMBtu last Wednesday to $13.50/MMBtu yesterday.

The Tennessee Zone 4 Marcellus spot price increased $1.92 from $3.21/MMBtu last Wednesday to $5.13/MMBtu yesterday, after reaching a weekly high of $5.97/MMBtu on Tuesday. The price at Dominion South in southwest Pennsylvania rose $2.60 from $3.32/MMBtu last Wednesday to $5.92/MMBtu yesterday, almost $2.00/MMBtu below the weekly high of $7.87/MMBtu reported for Tuesday.

Supply falls and production declines, while imports rise to multi-year highs. According to data from IHS Markit, the average total supply of natural gas fell by 9.5% compared with the previous report week. Dry natural gas production decreased to 79.5 Bcf/d, 12.0% lower than in the previous report week and 15% below the same week last year as a result of lower production, mainly in the Permian Basin. Deliveries of re-gasified natural gas from liquefied natural gas (LNG) import terminals, primarily at Everett, Massachusetts, and Elba Island, Georgia, averaged 0.45 Bcf/d for the report week, 118% more than last week and 131% more than the same week last year. Average net imports from Canada increased by 23.7% from last week, reaching an estimated 8.48 Bcf/d yesterday, the highest level since January 8, 2010, according to IHS Markit.

Average weekly demand rose to second-highest on record in response to high space heating and power generation consumption. According to data from IHS Markit, total U.S. consumption of natural gas rose by 12.0% compared with the previous report week to 128.9 Bcf/d, 2 Bcf/d below the weekly record set the week of December 28, 2017. Natural gas consumed for power generation climbed by 17.4% week over week. Industrial sector consumption increased by 6.1% week over week. In the residential and commercial sectors, consumption increased by 12.1%. Natural gas exports to Mexico decreased 14.1%, contributing to widespread power outages in northern Mexico that affected up to 4.7 million customers. Natural gas deliveries to U.S. liquefied natural gas (LNG) export facilities (LNG pipeline receipts) averaged 6.2 Bcf/d, or 4.78 Bcf/d lower than last week because of reductions in natural gas pipeline deliveries to LNG terminals.

U.S. LNG exports decrease week over week. Eleven LNG vessels (three each from Sabine Pass and Cameron, two each from Corpus Christi and Freeport, and one from Cove Point) with a combined LNG-carrying capacity of 40 Bcf departed the United States between February 11 and February 17, 2021, according to shipping data provided by Bloomberg Finance, L.P.

During the report week, U.S. LNG exports were affected by fog and extreme winter weather conditions that caused suspension of piloting services for several days at ports that serve LNG exports facilities, including Sabine Pass, Lake Charles port (location of Cameron LNG), and Corpus Christi.

https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2021/02_18/#tabs-storage-1

Natural Gas Weekly Update

for week ending February 24, 2021 | Release date: February 25, 2021

In the News:

Near-record cold temperatures drive near-record withdrawals from working natural gas stocks in the Lower 48 states

Working natural gas storage operators reported the second-largest weekly total net withdrawals ever reported for the Lower 48 states following a week characterized by widespread extreme cold throughout most of the country, which increased heating demand for natural gas. Net withdrawals from underground natural gas storage facilities totaled 338 billion cubic feet (Bcf) for the week ending February 19, 2021, exceeding the historical five-year average net withdrawals for the week by 218 Bcf (182%). Last week’s withdrawals were 21 Bcf lower than the all-time weekly record withdrawal of 359 Bcf, which was reported for the week ending January 5, 2018. As a result, working gas stocks fell to less than the five-year average by 161 Bcf.

Natural gas consumption in each of the main demand sectors increased during the report week, according to IHS Markit. Residential and commercial consumption averaged 62 billion cubic feet per day (Bcf/d) during the report week—the second-highest level in history after the record level of 64 Bcf/day reported for the week ending January 5, 2018. Electric power consumption of natural gas surpassed 33 Bcf/d, setting a new record winter high. In addition, industrial sector demand set a new record high of 28 Bcf/d.

Declines in production during the report week as a result of freeze-offs and shut-ins at natural gas wells in the Permian Basin also contributed to the increased withdrawals. Dry gas production in the Lower 48 states fell 12 Bcf/day to 77 Bcf/day for the week ending February 19, according to IHS Markit. Exports—both liquefied natural gas (LNG) and pipeline exports— declined 6.7 Bcf/day during the week, which lessened some of the need to withdraw natural gas from storage. Pipeline imports from Canada increased by 1.5 Bcf/day over the previous week to their highest levels since January 2010, which offset some of the declines in U.S. natural gas production.

Net withdrawals from natural gas storage facilities tend to be highly correlated with cold temperatures, which increase heating demand and, by extension, demand for natural gas. The first graph depicts this historical correlation between the weekly net change in working gas stocks and heating degree days (HDD)—a temperature-based measure of heating demand— during the heating season months (November 1–March 31) from January 2010 through last week.

Net changes in working gas stocks during the 2020–21 heating season (shown as red in the first graph) followed the general historical pattern, with higher HDDs generally leading to larger net withdrawals from working gas. During the first three months of the 2020–21 heating season weekly HDDs did not exceed 188 HDDs and the weekly net withdrawals also remained relatively small, with the largest weekly net withdrawal during this period totaling 187 Bcf. However, a period of sustained colder temperatures following the week ending January 28 resulted in a significant increase in HDDs and increased withdrawal activity. This increase peaked with the most recent report week, when significantly colder-than-normal temperatures resulted in 254 HDDs for the Lower 48 states—the third largest weekly total in history. Similarly, the largest weekly net withdrawals (359 Bcf) reported in the Lower 48 states coincided with the record-level 273 HDDs reported for the week ending January 5, 2018 (shown as green in the first graph).

The colder winter temperatures since late January prompted some of the largest natural gas storage withdrawal activity since the 2017–18 heating season. Total net withdrawals from underground natural gas storage facilities totaled 938 Bcf in the past four weeks (January 22—February 19). The cumulative withdrawals made up the third-largest four-week total reported since 2010, exceeded only by the record-setting 2013–14 and the 2017–18 heating seasons. In fact, two of the 15 largest weekly net withdrawals from storage occurred in the past two weeks.

The surplus to the five-year average natural gas inventory level has fallen in recent weeks because of higher natural gas storage withdrawals. The surplus to the five-year average last peaked at 244 Bcf on January 22. However, since then, net withdrawals have exceeded the five-year average. Working gas stocks are now 161 Bcf lower than the five-year average—the first deficit since December 2019.

Overview:

(For the week ending Wednesday, February 24, 2021)

- Natural gas spot prices fell at most locations this report week (Wednesday, February 17 to Wednesday, February 24) as temperatures across most of the Lower 48 states returned to normal or above-normal and heating and electricity demand declined from record-setting levels. The Henry Hub spot price fell from $23.61 per million British thermal units (MMBtu) last Wednesday to $2.75/MMBtu yesterday.

- At the New York Mercantile Exchange (NYMEX), the March 2021 contract expired yesterday at $2.854/MMBtu, down 37¢/MMBtu from last Wednesday. The April 2021 contract price decreased to $2.795/MMBtu, down 24¢/MMBtu from last Wednesday to yesterday. The price of the 12-month strip averaging April 2021 through March 2022 futures contracts declined 18¢/MMBtu to $2.964/MMBtu.

- The net withdrawals from working gas totaled 338 billion cubic feet (Bcf) for the week ending February 19. Working natural gas stocks totaled 1,943 Bcf, which is 13% lower than the year-ago level and 8% lower than the five-year (2016–2021) average for this week.

- The natural gas plant liquids composite price at Mont Belvieu, Texas, rose by 26¢/MMBtu, averaging $7.92/MMBtu for the week ending February 24. The price of ethane fell by 14%, reflecting declines in natural gas prices to which ethane prices are most closely correlated. Average weekly propane spot prices rose 10%, reflecting the highest weekly levels since October 2018. The prices of natural gasoline, normal butane, and isobutane rose by 7%, 5%, and 7%, respectively.

- According to Baker Hughes, for the week ending Tuesday, February 16, the natural gas rig count increased by 1 to 91. The number of oil-directed rigs fell by 1 to 305. The total rig count stayed at 397.

more summary data

Prices/Supply/Demand:

Prices across the country fall sharply from all-time highs. This report week (Wednesday, February 17 to Wednesday, February 24), the Henry Hub spot price fell $20.86 from $23.61/MMBtu last Wednesday to $2.75/MMBtu yesterday. At the Chicago Citygate, the price decreased $16.14 from $18.82/MMBtu last Wednesday to $2.68/MMBtu yesterday.

Northeast prices decline but from less elevated levels than in other regions. At the Algonquin Citygate, which serves Boston-area consumers, the price decreased $7.12 from $10.60/MMBtu last Wednesday to $3.48/MMBtu yesterday after reaching a weekly low on Tuesday at $3.18/MMBtu. At the Transcontinental Pipeline (Transco) Zone 6 trading point for New York City, the price decreased $10.85 from $13.50/MMBtu last Wednesday to $2.65/MMBtu yesterday. Algonquin Citygate and Transco Zone 6 both recorded weekly lows on Tuesday at $3.18/MMBtu and $2.59/MMBtu respectively.

Appalachia’s production basin prices declined week over week, but they remain higher than average January prices. The Tennessee Zone 4 Marcellus spot price decreased $2.82 from $5.13/MMBtu last Wednesday to $2.31/MMBtu yesterday after declining to a weekly low of $2.10/MMBtu on Tuesday. The price at Dominion South in southwest Pennsylvania fell $3.53 from $5.92/MMBtu last Wednesday to $2.39/MMBtu yesterday after recording a weekly low of $2.27/MMBtu on Tuesday. Prices at Tennessee Zone 4 and Dominion South were $0.04/MMBtu and $0.07/MMBtu higher yesterday, respectively, than they were on average in January.

Permian Basin prices decline as production increases and demand subsides. The price at the Waha Hub in West Texas, which is located near Permian Basin production activities, hit a weekly low of $2.56/MMBtu on Tuesday before settling at $2.65/MMBtu yesterday, which was $61.57/MMBtu lower than last Wednesday’s price of $64.22/MMBtu, and $203.50/MMBtu lower than the all-time record of $206.19/MMBtu set on Tuesday, February 16. Waha Hub prices were $40.61/MMBtu higher than the Henry Hub price last Wednesday. Yesterday, the price at the Waha Hub returned to a discount to Henry Hub at 10¢/MMBtu lower than Henry Hub.

California prices return to historical trend. The price at PG&E Citygate in Northern California fell $3.21, down from $6.90/MMBtu last Wednesday to $3.69/MMBtu yesterday. The price at SoCal Citygate in Southern California decreased $23.65 from $26.93/MMBtu last Wednesday to $3.28/MMBtu yesterday. The SoCal Citygate price is now back to a discount relative to PG&E, reflecting a return to lower prices at the Waha hub in the Permian Basin (where much of the natural gas for Southern California is sourced) relative to the Malin Hub on the California/Oregon border (where much of the natural gas delivered to Northern California is sourced). Malin prices peaked at $11.05/MMBtu last Tuesday, February 16, $195.14/MMBtu lower than Waha that day, and closed out last report week on Wednesday at $88.99/MMBtu lower than Waha. This Wednesday, Malin prices fell to $2.75/MMBtu, but they are now at a $0.10/MMBtu premium to Waha.

Supply rises, but remains lower than the week before last. According to data from IHS Markit, the average total supply of natural gas rose by 2.9% compared with the previous report week. After last week’s production losses due to freeze-offs, dry natural gas production increased by 4.1% compared with the previous report week. Dry gas production remains lower than normal at an estimated 9.2% lower than the week ending February 10 and 13.6% lower than the same week last year. Average net imports from Canada decreased by 9.1% from last week, but they remain elevated at 12.4% higher than the prior week and 25.3% higher than the same week last year.

Demand declines in response to lower heating and power demand. Total U.S. consumption of natural gas fell by 20.8% compared with the previous report week, according to data from IHS Markit. Consumption in the residential and commercial sectors declined by an estimated 28.1%, or 17.65 Bcf/d, the highest weekly decline on record. Natural gas consumed for power generation declined by 16.1% week over week. Industrial sector consumption decreased by 9.9% week over week. Natural gas exports to Mexico increased 0.7%. Natural gas deliveries to U.S. liquefied natural gas (LNG) export facilities (LNG pipeline receipts) averaged 7.4 Bcf/d, or 1.2 Bcf/d higher than last week.

U.S. LNG exports increase week over week. Fourteen LNG vessels (seven from Sabine Pass; two each from Cove Point and Cameron; and one each from Corpus Christi, Elba Island, and Freeport) with a combined LNG-carrying capacity of 50 Bcf departed the United States between February 18 and February 24, according to shipping data provided by Bloomberg Finance, L.P.

Storage:

The net withdrawals from storage totaled 338 Bcf for the week ending February 19, compared with the five-year (2016–2021) average net withdrawals of 120 Bcf and last year’s net withdrawals of 145 Bcf during the same week. Working natural gas stocks totaled 1,943 Bcf, which is 161 Bcf lower than the five-year average and 298 Bcf lower than last year at this time.

According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net withdrawals of 287 Bcf to 371 Bcf, with a median estimate of 336 Bcf.

The average rate of withdrawals from storage is 22% higher than the five-year average so far in the withdrawal season (November through March). If the rate of withdrawals from storage matched the five-year average of 7.5 Bcf/d for the remainder of the withdrawal season, the total inventory would be 1,645 Bcf on March 31, which is 161 Bcf lower than the five-year average of 1,806 Bcf for that time of year.

More storage data and analysis can be found on the Natural Gas Storage Dashboard and the Weekly Natural Gas Storage Report.

https://www.eia.gov/naturalgas/weekly/archivenew_ngwu/2021/02_25/#tabs-storage-1

Natural Gas Weekly Update

for week ending March 3, 2021 | Release date: March 4, 2021

Prices/Supply/Demand:

Prices across the country moved within a narrow band this week, reflecting a gradual return to normal levels of production and demand. This report week (Wednesday, February 24 to Wednesday, March 3), the Henry Hub spot price rose 9¢ from $2.75/MMBtu last Wednesday to $2.84/MMBtu yesterday after reaching a weekly low of $2.65/MMBtu on Friday.

Prices across the Midwest increased slightly. The Midwest Regional Average price rose by 4¢/MMBtu, or 1%, from $2.67/MMBtu last Wednesday to $2.71/MMBtu yesterday. The Chicago Citygate price increased more than the regional average, increasing 8¢ from $2.68/MMBtu last Wednesday to $2.76/MMBtu yesterday after reaching a weekly high of $2.79/MMBtu on Tuesday.

California prices increased. The price at PG&E Citygate in Northern California rose 5¢, an increase from $3.69/MMBtu last Wednesday to $3.74/MMBtu yesterday after dropping to a weekly low of $3.58/MMBtu on Friday. The price at SoCal Citygate in Southern California increased 25¢ from $3.28/MMBtu last Wednesday to $3.53/MMBtu yesterday. The SoCal price increase was the result of reported maintenance on the El Paso Natural Gas Pipeline near the Hackberry, Arizona compressor station as well as maintenance on the Kern River Gas Transmission Company’s Goodsprings Compressor Station outside of Las Vegas, Nevada.

Prices in the Northeast rise in response to lower-than-normal temperatures late in the report week. At the Algonquin Citygate, which serves Boston-area consumers, the price went up $4.76 from $3.48/MMBtu last Wednesday to a weekly high of $8.24/MMBtu yesterday. Temperatures across New England fell approximately 12ºF lower than normal yesterday, and they are expected to remain lower than normal through the weekend. IHS Markit reports higher natural gas pipeline flows into the region and increased sendout from the Everett liquefied natural gas (LNG) import terminal. Estimated demand rose to 4,446 million cubic feet on March 2—the highest level since February 12. At the Transcontinental Pipeline Zone 6 trading point for New York City, the price increased 26¢ from $2.65/MMBtu last Wednesday to $2.91/MMBtu yesterday after falling to a weekly low of $2.34/MMBtu last Thursday. Temperatures across the Mid-Atlantic regions fell approximately 5ºF lower than normal on Tuesday and Wednesday, resulting in elevated residential heating demand.

Appalachia Basin production area prices rise in response to increased Northeast demand. Prices throughout the Appalachia region reached weekly highs yesterday. The Tennessee Zone 4 Marcellus spot price increased 13¢ from $2.31/MMBtu last Wednesday to $2.44/MMBtu yesterday. The price at Dominion South in Southwest Pennsylvania rose 11¢ from $2.39/MMBtu last Wednesday to $2.50/MMBtu yesterday.

Prices throughout the Permian production region were relatively flat week-over-week. After falling to $2.39/MMBtu, the price at the Waha Hub in West Texas, which is located near Permian Basin production activities, averaged $2.65/MMBtu last Wednesday, 10¢/MMBtu lower than the Henry Hub price. Yesterday, the price at the Waha Hub averaged $2.64/MMBtu, 20¢/MMBtu lower than the Henry Hub price. The West Texas/Southeast New Mexico average declined 2¢/MMBtu from $2.64/MMBtu last Wednesday to $2.62/MMBtu yesterday.

Prices at delivery points into the Pacific Northwest decline. The price at Sumas on the Canada-Washington border fell 7¢ from $2.71/MMBtu last Wednesday to $2.64/MMBtu yesterday. The price at the Opal Hub in Southwest Wyoming fell 8¢ from $2.75/MMBtu last Wednesday to $2.67/MMBtu yesterday. These price declines were reflected in lower prices at the Malin, Oregon hub, which supplies major demand centers in Oregon and Northern California. The Malin price fell 1¢/MMBtu from $2.75 last Wednesday to $2.74/MMBtu yesterday.

Supply continues to recover as estimated dry gas production rises to early February levels. According to data from IHS Markit, the average total supply of natural gas rose by 6.7% compared with the previous report week. Dry natural gas production grew by 10.1% compared with the previous report week, averaging more than 90 Bcf/d for the first time since the week ending February 10. Average net imports from Canada decreased by 31.7% from last week, reaching the lowest weekly average since the week ending December 1, 2020, reflecting growth in U.S. domestic production. Half of the total decline in pipeline imports from Canada was into the Midwest, where warmer-than-normal temperatures resulted in decreased heating demand for natural gas.

Demand declines as temperatures continue to rise across most of the Lower 48 states. Total U.S. consumption of natural gas fell by 12.8% compared with the previous report week, according to data from IHS Markit. The residential and commercial sectors led demand declines with a combined decline of 22.4%. Natural gas consumed for power generation declined by 5.2% week over week. Industrial sector consumption decreased by 4.2% week over week. Total exports increased. Pipeline natural gas exports to Mexico increased 8.4% to approximately 5.5 Bcf/d, approaching levels reported prior to the second week of February. Natural gas deliveries to U.S. LNG export facilities (LNG pipeline receipts) also reached their highest levels since the week of February 10, averaging 9.8 Bcf/d, which was 2.3 Bcf/d higher than last week.

U.S. LNG exports increase week over week. Seventeen LNG vessels (five from Sabine Pass, three each from Cameron, Corpus Christi, and Freeport; two from Cove Point; and one from Elba Island) with a combined LNG-carrying capacity of 62 Bcf departed the United States between February 25 and March 3, according to shipping data provided by Marine Traffic.

Storage:

The net withdrawals from storage totaled 98 Bcf for the week ending February 26, compared with the five-year (2016–2021) average net withdrawals of 81 Bcf and last year’s net withdrawals of 119 Bcf during the same week. Working natural gas stocks totaled 1,845 Bcf, which is 178 Bcf lower than the five-year average and 277 Bcf lower than last year at this time.

According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net withdrawals of 109 Bcf to 162 Bcf, with a median estimate of 138 Bcf.

The average rate of withdrawals from storage is 22% higher than the five-year average so far in the withdrawal season (November through March). If the rate of withdrawals from storage matched the five-year average of 6.6 Bcf/d for the remainder of the withdrawal season, the total inventory would be 1,628 Bcf on March 31, which is 178 Bcf lower than the five-year average of 1,806 Bcf for that time of year.

More storage data and analysis can be found on the Natural Gas Storage Dashboard and the Weekly Natural Gas Storage Report.

https://www.eia.gov/naturalgas/weekly/#tabs-prices-1

MARCH 5, 2021

Natural gas spot prices at several trading hubs approached their record highs briefly during the week of February 14 amid significantly colder-than-normal weather that affected most of the Lower 48 states. The cold weather led to natural gas supply and demand imbalances. Natural gas production declined because of freeze-offs (temporary interruptions in production caused by cold weather) amid high demand for heating and power. At the benchmark Henry Hub, natural gas prices reached $23.86 per million British thermal units (MMBtu) on February 17, the highest real (inflation-adjusted) price since an Arctic blast on February 25, 2003. Henry Hub prices averaged $5.49/MMBtu in February, the highest monthly average since February 2014.

any regional natural gas trading hubs also reached very high spot prices. In mid-February, 105 of the 178 natural gas pricing points reached recent high prices, according to Natural Gas Intelligence (NGI) data. High prices predominately occurred in the South, Southwest, and Midwest regions of the United States.

The Permian Basin in West Texas was significantly affected by freeze-offs. The spot price at the nearby Waha Hub reached $206.19/MMBtu on February 16, compared with an average of $2.83/MMBtu during the first week of February. Southern California also experienced higher prices because a significant amount of its natural gas supply comes from the Permian Basin. The price at Southern California (SoCal) Citygate reached $144.00/MMBtu on February 12. By comparison, the daily price at Pacific Gas and Electric (PG&E) Citygate, located in Northern California, was considerably lower at $6.25/MMBtu because Northern California receives more of its natural gas from the Rocky Mountain region and Western Canada.

In Oklahoma, Oneok Gas Transmission (OGT) reached what might be the highest natural gas price at any natural gas hub in history at an average of $1,192/MMBtu on February 17, according to NGI data. The spot price at OGT was $2.91/MMBtu during the first week of February.

The elevated spot prices throughout the United States were short lived. As temperatures rose, alleviating supply constraints and tempering demand, natural gas spot prices at the Henry Hub quickly began to decline to pre-cold snap levels, reaching $2.84/MMBtu on February 22.

Principal contributor: Stephen York